The Definitive Guide to Pacific Prime

In the USA, medical insurance is a volunteer matter, yet many individuals are involuntarily without coverage. There is no guarantee for many people under the age of 65 that they will certainly be qualified for or able to pay for to buy or maintain health and wellness insurance policy. Virtually 7 out of every ten Americans under age 65 years are covered by employment-based health insurance, either from their job or via a moms and dad or partner.

A modification in insurance coverage premium or terms, as well as adjustments in earnings, health and wellness, marital status, regards to work, or public laws, can trigger a loss or gain of medical insurance coverage. For about one-third of the without insurance populace, being without coverage is a temporary or single disruption of coverage, and the typical duration of a duration without insurance coverage is between 5 and 6 months.

The Ultimate Guide To Pacific Prime

Considering that the mid-1970s, growth in the expense of wellness insurance coverage has actually surpassed the increase in actual income, producing a void in purchasing capability that has actually included roughly one million persons to the rankings of the without insurance each year. group insurance plans. Despite the economic success of recent years, between 1998 and 1999 there was just a slight decrease in the numbers and percentage of without insurance Americans

Because the mid-1990s, boosts in employment-based insurance coverage have actually been countered by steady or declining prices of public and independently acquired coverage. * Altogether, regarding 83 percent of the nonelderly populace is covered by employment-based, specific and public plans. Some people report greater than one resource of coverage over the program of a year.

The clergy and various other spiritual workers comprise the biggest solitary classification of individuals without connections to Social Protection and Medicare. 3In 1996, the CPS price quote of the number of nonelderly persons uninsured was 41 million (Fronstin, 2000a) (https://www.openstreetmap.org/user/pacificpr1me).4 The government Emergency situation Medical Treatment and Active Labor Act, part of the Consolidated Omnibus Budget Settlement Act of 1985, calls for health center emergency situation areas to analyze and support all individuals with a life- or limb-threatening or emergency medical problem or those that will provide birth

Pacific Prime Fundamentals Explained

Companies commonly use health insurance coverage, and occasionally life insurance and special needs insurance policy, as a workplace advantage. When you get insurance with a company, you might have a choice of one or more strategies that your company has pre-selected and your employer may pay some or all of the premiums for your insurance coverage.

Restricted insurance policy refers to a subsidiary company developed to offer insurance policy to the parent business and its associates. A captive insurer stands for an option for numerous firms and teams that intend to take monetary control and handle threats by financing their very own insurance policy as opposed to paying costs to third-party insurers.

The smart Trick of Pacific Prime That Nobody is Talking About

For several years currently, Vermont has actually placed as the number one captive domicile in the United States and in 2022 became the number one-ranked abode globally - https://www.find-us-here.com/businesses/Pacific-Prime-Agoura-Hills-California-USA/34031837/. Vermont's success to day can be connected to a mix of variables, not the least of which is the recurring management of Vermont's Governors, both previous and present, and both houses of the State Legislature who remain to promote Vermont's historical practice of providing solid support for this state's captive sector

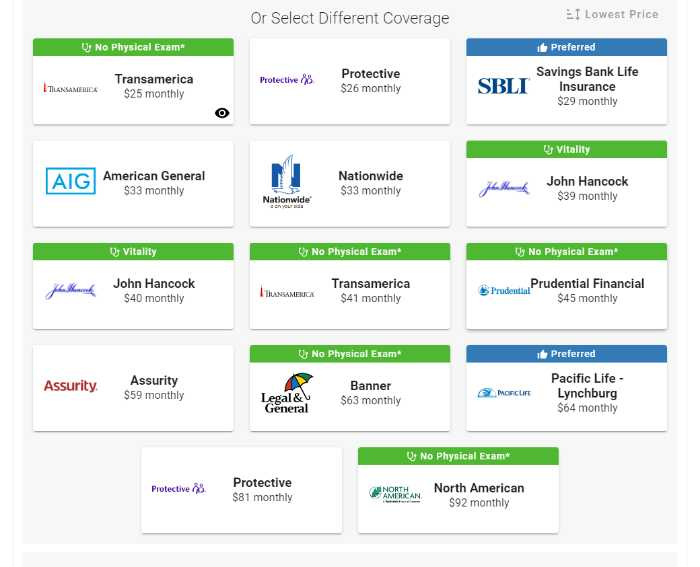

Lots of New Yorkers spend considerable sums of cash yearly on life insurance coverage premiums with extremely little concept of what they are obtaining for their money - global health insurance. Usually customers do not recognize that there see it here are major differences in the kinds of life insurance policy they can get and the resources for such insurance coverage

:max_bytes(150000):strip_icc()/what-main-business-model-insurance-companies.asp-FINAL-092abcf238d348c4975e1021489191e6.png)